How the BCG Matrix Helps the Agriculture Industry and Why You May Be Missing Your Target

Take a look at your marketing ROI.

Do you like what you see? Or does it feel like no matter how much you spend marketing that one product or service, the return never grows? Maybe you keep missing your target all together.

Whether you manufacture big iron, produce and distribute products for animal health, or work in the crop sciences, if you don’t have a clear picture of who makes up your ideal audience or know where your products and services stand in the market, then your marketing efforts won’t breed the results your company deserves.

Get to Know Your Ideal Buyers

The first steps toward marketing your product portfolio more efficiently is knowing who you want to target and putting measures in place that will help you adapt your ideal audience as the market continually evolves.

Just because you’ve always marketed and sold to the same audience doesn’t necessarily mean that’s the best audience for your products. You might be surprised by the who once it’s backed by research and market data – and you might just expand your audience or pivot to find the best places to spend your time, money, and efforts. Intrigued? Let’s dig in.

Start with:

1.] Developing Personas.

Buyer personas, or the semi-fictional representations of your ideal customers, are based on market research and the data you already have in your existing customer base.

They will serve as the foundation of your inbound marketing strategy by helping you determine where to focus your resources, guiding product development, and fostering company-wide alignment.

With strong, detailed personas in place, you’ll be able to attract the most valuable visitors to your brand.

2.] Marketing Segmentation.

At its core, marketing segmentation is the practice of splitting up your customer base into smaller, more targeted groups. These subsets are often centered around things like priority level, demographics, or needs and can be used to optimize the marketing of products and services to Ideal Client Profiles (ICPs).

3.] Multi-Channel Approach.

Reaching out to your customers where they are is a fundamental part of inbound marketing in the ag sector—that’s why implementing a multi-channel strategy is so important.

When you use multiple promotional channels (like social media, email, or print advertisements), you’re not only spreading your message far and wide, but you’re also creating multiple “touch points” that keep your company top of mind when your prospects are making buying decisions.

Once you have a firm idea of who and how to connect with your ideal audience, it’s time to consider where your products fit into the equation.

If you want to be able to make even more informed marketing decisions, you’ll need to develop a strategy to analyze your product portfolio and determine where you are making money, where you need to spend money, and where you can disrupt the market with something new.

That’s where the BCG matrix comes in.

The BCG Matrix

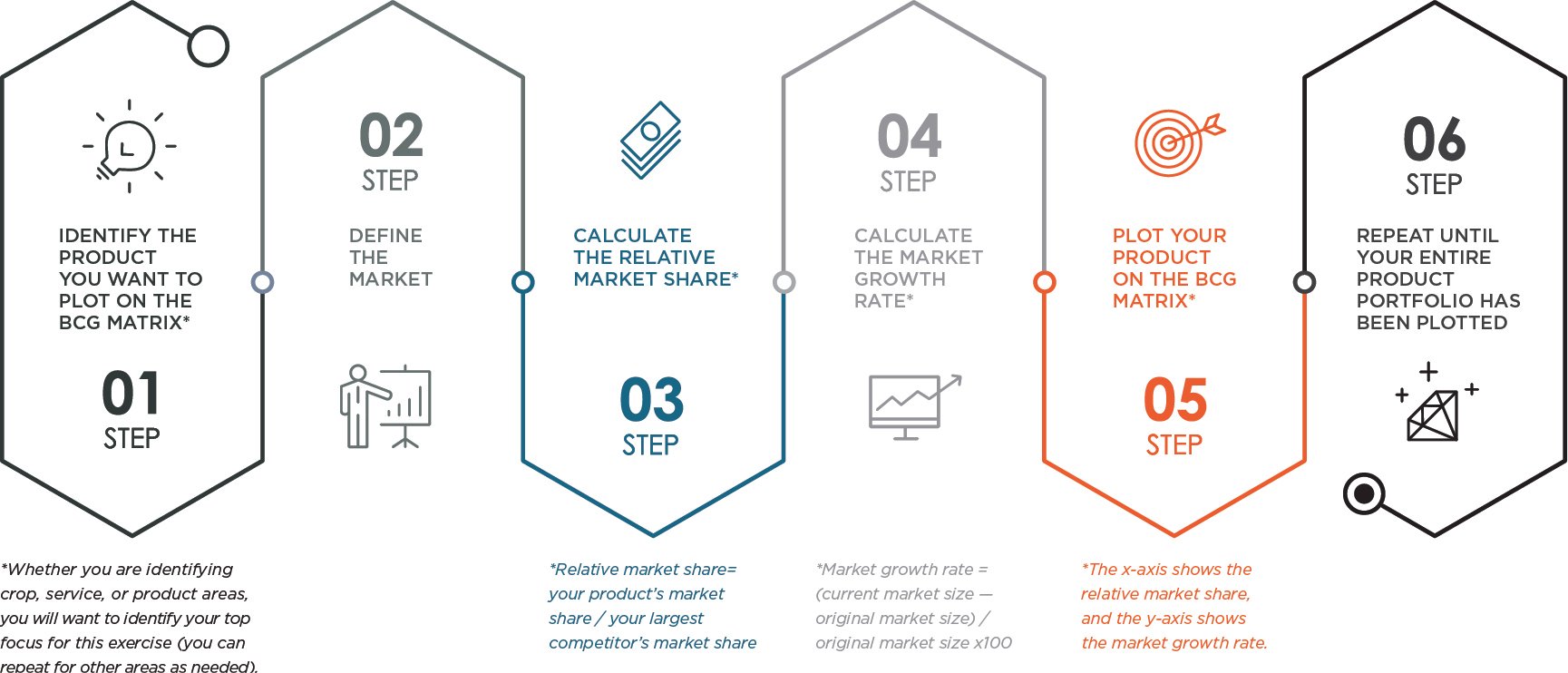

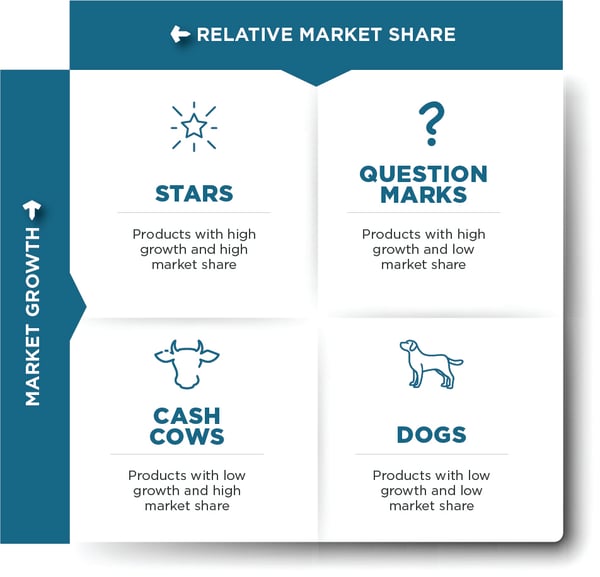

Created by the Boston Consulting Group in the early 1970s, the BCG matrix is a marketing and sales tool that helps corporate businesses strategically visualize their product portfolios.

The BCG matrix helps companies gain insight on which products to invest in, develop further, or discontinue by introducing a long-term strategy for analyzing products based on two primary factors:

-

-

Market Growth. The number of buyers a particular product or service has in the market.

-

-

-

Relative Market Share. The amount of space a product or service holds within the market.

-

The BCG matrix is divided into four quadrants: stars, cash cows, question marks, and dogs.

Let’s break it down.

-

- Stars: Products with high growth and high market share. Stars are typically a company’s flagship product—they create large amounts of cash but also require large investments to fight off competitors. Products that fall into this category have the potential to turn into cash cows if their success is sustained and the market slows.

-

- Cash Cows: Products with low growth and high market share. Cash cows are market leaders that create more cash than they consume. The profits from these products should be “milked” as much as possible (without running poor Bessie dry) and invested into stars and/or question marks.

-

- Question Marks: Products with high growth and low market share. Also known as the “problem child,” question marks require far more cash than they can generate. While these products typically lose money, they have the potential to turn into stars as their market share grows.

-

- Dogs: Products with low growth and low market share. Often considered “cash traps,” dogs don’t create or consume a large amount of cash and are likely to be divested or liquified.

You might have noticed that there’s a correlation between the BCG matrix and a product’s lifecycle stage.

Most products will begin their lifecycle as a question mark. If these products are able to maintain their category leadership as their market grows, then they become stars. Over time, the market is likely to slow, morphing stars into cash cows. Finally, as a product enters the twilight of its life and sales growth declines or flatlines altogether, cash cows could become dogs.

Of course, it’s important to note that the correlation between the BCG matrix and product lifecycle isn’t a guarantee. Question marks could take a turn for the worse, bypass the middle stages, and go straight to the doghouse (they are the problem child, after all).

So, now that you understand what a BCG matrix is, why does it matter? How will taking the time to analyze and plot your product portfolio help you target your ideal buyers?

In the words of Bruce Henderson, the brain behind the Boston Consulting Group matrix:

Every company needs products in which to invest cash. Every company needs products that generate cash. And every product should eventually be a cash generator; otherwise it is worthless. Only a diversified company with a balanced portfolio can use its strengths to truly capitalize on its growth opportunities.

Now, let’s put it all into perspective.

The BCG Matrix vs. Murphy's Mowers

Let’s pretend that I own my own lawn equipment manufacturing company—Murphy’s Mowers. I take a good look at my portfolio and determine where each of my products fit into the BCG matrix.

-

- Stars—Residential Lawn Mowers. As star products, my residential lawn mowers bring in a lot of revenue BUT require a heavy investment due to their high relative market share and number of competitors. However, these stars are still essential to my business because they ensure future growth.

- Stars—Residential Lawn Mowers. As star products, my residential lawn mowers bring in a lot of revenue BUT require a heavy investment due to their high relative market share and number of competitors. However, these stars are still essential to my business because they ensure future growth.

-

- Cash Cows—Commercial Lawn Mowers. Since my commercial lawn mowers are my cash cows, they perform consistently (especially when it comes to return on investment). My brand and quality of product is well-established and trusted within this market share, so I don’t need to invest too much into advertising to my audience here.

I’ll continue to milk my commercial lawn mowers (within reason) by getting a greater return on the small investment I make.

- Cash Cows—Commercial Lawn Mowers. Since my commercial lawn mowers are my cash cows, they perform consistently (especially when it comes to return on investment). My brand and quality of product is well-established and trusted within this market share, so I don’t need to invest too much into advertising to my audience here.

-

- Question Marks—Golf and Sports Turf Mowers. As my problem children, my golf and sports turf mowers have the potential to become stars OR dogs. This is why they require heavy investing and development to draw a return. I need to do a little strategic experimentation and advertising to determine how much these question marks are worth to my business (the extra money I bring in from my commercial lawn mowers comes in handy here).

I can hope that my golf and sports turf mowers will join my residential mowers as stars, but I need to be prepared for either outcome.

- Question Marks—Golf and Sports Turf Mowers. As my problem children, my golf and sports turf mowers have the potential to become stars OR dogs. This is why they require heavy investing and development to draw a return. I need to do a little strategic experimentation and advertising to determine how much these question marks are worth to my business (the extra money I bring in from my commercial lawn mowers comes in handy here).

-

- Dogs—Mower Attachments and Accessories.When it comes to my mower attachments and accessories, I have a couple of options. I can either remove these products from my portfolio or continue to offer them WITHOUT any further investments. It’s important that I don’t try to pump all my assets into these attachments and accessories because it will end up draining my resources and wasting my money.

There is no shame in having a few dogs in your portfolio, especially since they might bring value to your customers on occasion (like if someone wanted to add a brush guard attachment to their residential mower).

- Dogs—Mower Attachments and Accessories.When it comes to my mower attachments and accessories, I have a couple of options. I can either remove these products from my portfolio or continue to offer them WITHOUT any further investments. It’s important that I don’t try to pump all my assets into these attachments and accessories because it will end up draining my resources and wasting my money.

Now that I know where each of my products stand in the market, I can pair this data with the information I have curated about my target audience and formulate a well-educated strategy to make the most out of my marketing budget.

See how it all comes together?

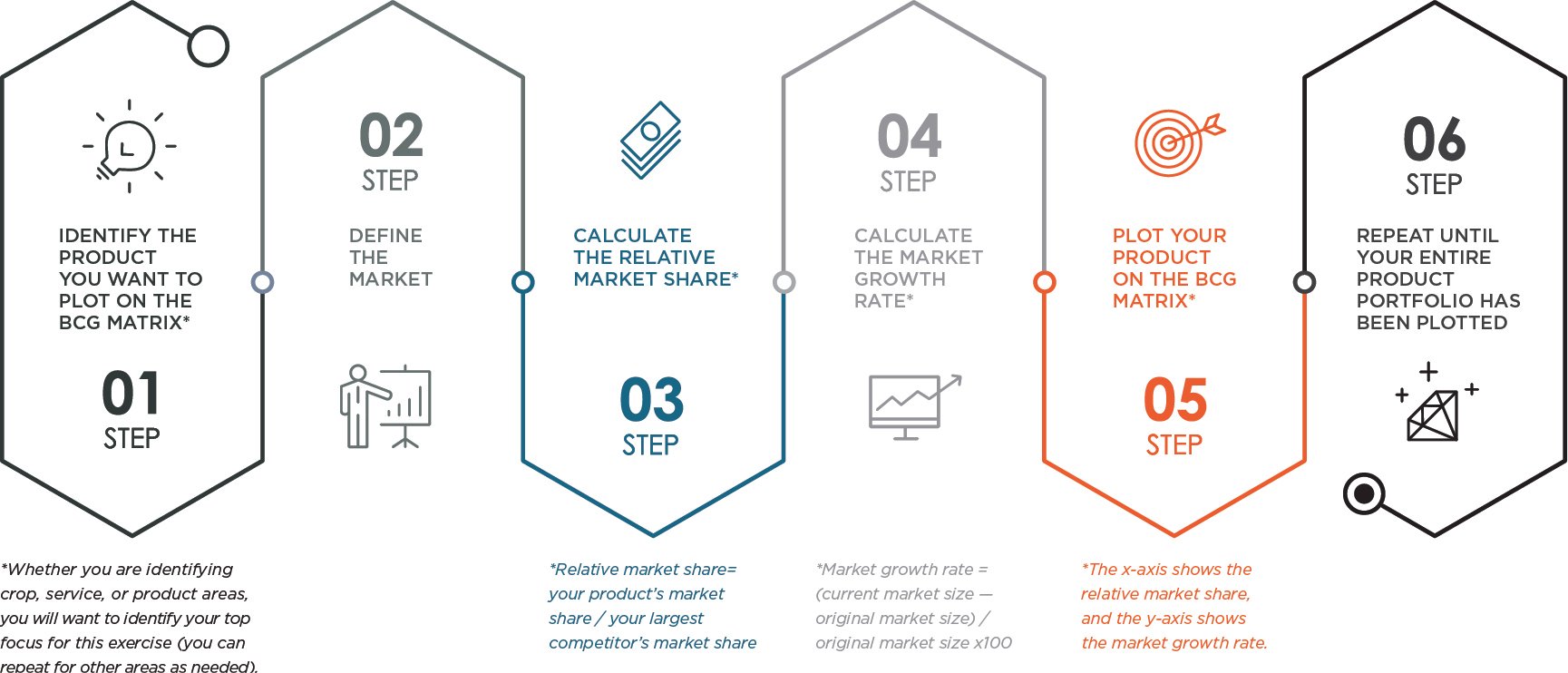

Download Our Worksheet to Start Plotting Your Own BCG Matrix

Ready to stop spinning your marketing tractor wheels in the mud and start marketing your products more efficiently? Analyzing and plotting your product portfolio on the BCG matrix is a step in the right direction!

Please note: The BCG matrix is only recommended for large and corporate-level companies. With small to medium-sized companies, the relative market share is often too small to quantify, making it difficult to properly classify products.

Click the form on the right to download our easy-to-use worksheet to start categorizing each of your products within the BCG matrix.